Why KENZ Financial

Whatever Your Business Needs, There’s A Real Estate Business Loan for that

Fast Funding

Apply in Just 10 Minutes for a Same-Day Call and Free Pre-Approval Consultation

Easy Rate Comparisons

We've partnered with 75 + lenders, each of

which may want your business.

Expert Guideline

Realtors can apply in just 15 minutes. Once

approved, it's possible to receive full funding

in as little as 24 hours.

Real Estate Solutions offered with our lending network

Whatever your business needs, there’s a small business loan for that.

Type

Highlights

Qualifications

LTV & additional info

Get an Offer

Type

Conforming Loans

Conforming loans adhere to Fannie Mae and Freddie Mac guidelines, ideal for those within conforming loan limits. Offers competitive terms suitable for various buyers or those refinancing.

Higlights

Low interest rates

Fixed and adjustable-rate options

Streamlined approvals

Qualifications

Mortgage amount ≤ $726,200

Good/excellent credit

Easy-to-document income

LTV & additional info

LTV: Varies by program specifics, often up to 97% for qualified buyers.

Get an Offer

Type

Non-Conforming Loans

Designed for loans exceeding conforming limits, offering jumbo options up to $30 million. Accommodates borrowers with complex financial scenarios or non-owner-occupied properties.

Higlights

Flexible options for higher loan amounts

$0 Lender Fee

Customization available

Qualifications

Loan amount > $726,200

Jumbo and Super Jumbo options

Complex financial situations

LTV & additional info

LTV: Up to 90% for certain products, tailored to borrower's financial situation.

Get an Offer

Type

FHA Loans

FHA loans, insured by the FHA, offer lenient credit and down payment requirements, suitable for first-time home buyers or those refinancing.

Higlights

Low down payments (3.5% minimum)

Lower credit scores accepted

Flexible guidelines

Qualifications

Relaxed credit requirements

Down payment or home equity < 20%

LTV & additional info

LTV: Up to 96.5% for purchases, allowing down payments as low as 3.5%.

Get an Offer

Type

Jumbo & Super Jumbo Loans

Targets financing for luxury homes or high-priced investments, with loans exceeding the conforming loan limit and up to $30 million. Offers flexibility and tailored options for high-value properties.

Higlights

Competitive rates - Flexible terms

Up to $30 million loans

Qualifications

Loan amounts exceeding conforming limits

Complex financial or unique property situations

LTV & additional info

LTV: Up to 90% for purchase loans, specific conditions apply.

Get an Offer

Type

Non-QM & Portfolio Loans

Customizable loans ranging from $150,000 to $30 million for borrowers with complex finances or unique needs, including bridge-to-sale and cross-collateralization options.

Higlights

High loan amounts, low fees

Flexible underwriting

Custom mortgages

Qualifications

Non-traditional incomes<br>- Complex financial needs

LTV & additional info

LTV: Varies, with products allowing up to 80% LTV for acquisitions and refinancing.

Get an Offer

Type

Non-QM & Portfolio Loans

Customizable loans ranging from $150,000 to $30 million for borrowers with complex finances or unique needs, including bridge-to-sale and cross-collateralization options.

Higlights

High loan amounts, low fees

Flexible underwriting

Custom mortgages

Qualifications

Non-traditional incomes<br>- Complex financial needs

LTV & additional info

LTV: Varies, with products allowing up to 80% LTV for acquisitions and refinancing.

Get an Offer

Type

ITIN Home Loans

Facilitates home purchases for individuals without an SSN but who have an ITIN, expanding access to home ownership.

Higlights

Enables home buying without SSN

Qualifications

Must have an Individual Tax Identification Number (ITIN)

LTV & additional info

LTV: Specific LTV ratios depend on borrower qualifications and loan details.

Get an Offer

Type

Construction Home Loans

Ideal for constructing a new home or making significant improvements, providing tailored financing solutions.

Higlights

Financing for building or improving homes

Qualifications

Tailored to buyers looking to build or make improvements

LTV & additional info

LTV: Up to 80% for construction projects, varies based on project specifics and borrower's financial situation.

Get an Offer

Type

Agency Multifamily

Offers multifamily capital solutions, specializing in small to middle market investors with loans ranging from $750k to $100MM. Focuses on education and execution for agency debt.

Higlights

Broad market access

Institutional leverage and pricing

Qualifications

Small to middle market multifamily investors

Loans between $750k and $100MM

LTV & additional info

LTV: Up to 80% for acquisitions and refinancing, specific to agency guidelines.

Get an Offer

Type

Fix and Flip Bridge Loans

Supports investors in fix-and-flip projects with flexible terms and loan amounts up to $10 million. Includes financing for purchase costs and rehab budgets.

Higlights

Tailored offerings

Ranges from $50,000 to $10,000,000

Qualifications

Non-owner occupant

Personal guarantees required

Minimum credit score: 600

LTV & additional info

LTV: Up to 70% of After Repaired Value (ARV), financing up to 100% of rehab budget.

Get an Offer

Type

Multifamily Bridge Loans

Tailored for the acquisition/repositioning of value-add multifamily properties, with loans from $2.5 million to $30 million. Supports specific business plans with creative structuring.

Higlights

Acquisition and repositioning support

Up to $30,000,000 loans

Qualifications

Experienced investors

Non-owner occupant

Multifamily experience required

LTV & additional info

LTV: Up to 75% for purchases and repositioning efforts, appraisal waivers available for loans below $15 million.

Get an Offer

Type

DSCR Rental Loan Program

Offers fixed rate loans for one to four unit rental properties, catering to investors seeking acquisition, refinance, or cash-out options without traditional income verification.

Higlights

No income verification needed

Loan amounts up to $2,500,000+

Fixed rate loans

Qualifications

Minimum credit score: 660

One to four unit rental properties

Corporate or individual borrowers

LTV & additional info

LTV: Up to 80% for acquisitions and refinancing, tailored to investor needs using DSCR calculations.

Get an Offer

Type

DSCR Portfolio Loan Program

Designed for investors with portfolio properties, providing acquisition, rate and term refinance, and cash-out options. Offers flexibility for non-traditional income sources and complex ownership structures.

Higlights

Tailored for portfolio properties

Loan amounts up to $10,000,000

Flexible underwriting

Qualifications

Minimum credit score: 660

Non-owner occupied, rent-ready properties

Complex ownership structures considered

LTV & additional info

LTV: Up to 80% for acquisitions and refinancing, select non-recourse options available for specific qualifications.

Get an Offer

Type

Commercial Real Estate Loans

Financing solutions for the purchase, renovation, or refinance of commercial properties, tailored to meet the specific needs of the investment.

Higlights

Financing for various property types

Tailored to commercial investments

Qualifications

Income-generating potential

Borrower's creditworthiness

Investment experience

LTV & additional info

LTV: Typically up to 75%, based on the property type and borrower qualifications.

Get an Offer

Type

SBA 7(a) and 504 Loans

Offers small business owners competitive financing for purchasing or refinancing commercial real estate, backed by the SBA.

Higlights

Government-backed

Competitive rates and terms

Small business owners

Qualifications

Operational for at least 2 years

Use of property for business operations

LTV & additional info

LTV: Up to 90% for 504 loans; terms up to 25 years for real estate under 7(a) loans.

Get an Offer

Type

Land Development Loans

Supports the transformation of raw land into construction-ready sites or for commercial use, providing the necessary capital for development.

Higlights

For acquisition and development of land

Turns raw land into build-able lots

Qualifications

Detailed development plan

Experienced developers

Strong financial

LTV & additional info

LTV: Often up to 60-75%, based on the land purchase price or developed value.

Get an Offer

Type

Mezzanine Financing

A flexible financing option that provides capital beyond what is available through traditional loans, often used in large commercial projects.

Higlights

Hybrid of debt and equity

Convertible to equity interest in case of default

Qualifications

For large commercial projects or acquisitions

Additional capital beyond traditional loans

LTV & additional info

Terms and conditions vary widely, tailored to the project and partnership agreements.

Get an Offer

Type

Hard Money Loans

Ideal for quick financing needs, such as rehabbing or flipping properties, where traditional financing is not an option.

Higlights

Short-term, asset-based

Higher interest rates than traditional loans

Qualifications

Based on property value

Quick funding needs

LTV & additional info

LTV: Up to 65-75% of the property's current value; terms typically 12 months or less.

Get an Offer

Type

Hard Money Loans

Ideal for quick financing needs, such as rehabbing or flipping properties, where traditional financing is not an option.

Higlights

Short-term, asset-based

Higher interest rates than traditional loans

Qualifications

Based on property value

Quick funding needs

LTV & additional info

LTV: Up to 65-75% of the property's current value; terms typically 12 months or less.

Get an Offer

Type

Bridge Loans for Transitional Properties

Provides liquidity for investors and developers to bridge the gap between purchase or renovation and securing long-term financing.

Higlights

Short-term financing for renovation or repositioning

Quick liquidity

Qualifications

Transitional or value-add commercial properties

Clear exit strategy

LTV & additional info

LTV: Typically up to 70-80% of purchase price or value upon completion; 1 to 3 years terms.

Get an Offer

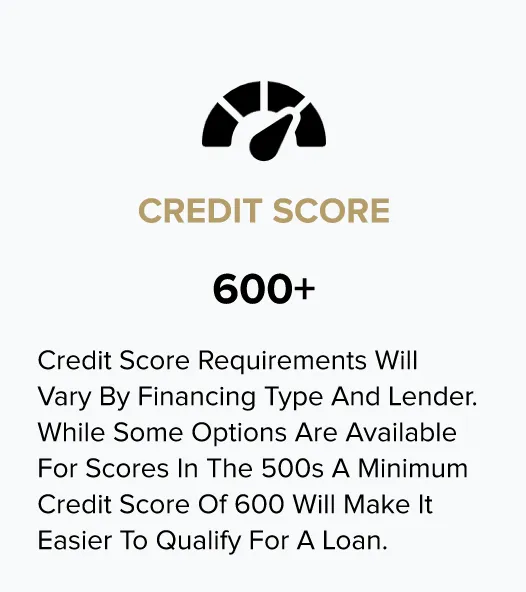

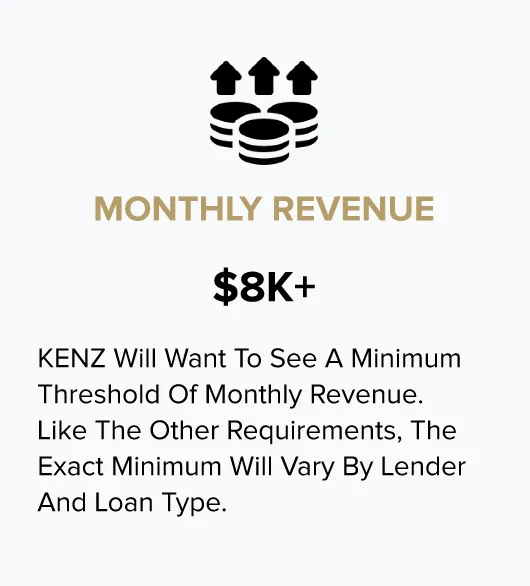

Minimum Requirements For Small Business Loans

Qualifications for being given funding will vary by loan product and lender

Reviews from real estate agents

FAQs

1. What are real estate agent business loans?

Real estate agent business loans are financial solutions tailored to support the unique needs of real estate professionals. These loans can be used for various purposes, including marketing, expanding the business, bridging cash flow gaps, or investing in new technologies. They are designed to accommodate the fluctuating income and specific operational requirements of real estate agents, offering them the financial flexibility to grow their business and meet their goals.

2. What are the requirements to get a loan for a real estate agent?

To secure a loan as a real estate agent, requirements often include a strong credit history, proof of steady income, business financial statements, and a solid business plan. Lenders may also evaluate your experience in the real estate industry and the potential for future earnings. Specific criteria can vary by lender, so it's important to consult directly with the financing institution for their unique requirements.

3. What can I use realtor loans for?

Realtor loans can be used for various purposes such as marketing and advertising, office space rental, technology upgrades, hiring staff, and professional development. These funds allow real estate agents to invest in areas that will help grow their business, enhance their services, and maintain a competitive edge in the market.

4. What are the benefits of an online loan marketplace?

An online loan marketplace offers several benefits, including a wide range of loan options from various lenders, competitive rates, and the convenience of applying from anywhere. It simplifies the comparison of loan terms and rates, ensuring that borrowers can find the best deal suited to their needs. This platform also speeds up the loan approval process, making it easier and faster for businesses to access needed funds.

5. What are the different types of SBA loans?

The Small Business Administration (SBA) offers several types of loans, including 7(a) loans, which are general purpose loans for various business needs; CDC/504 loans, aimed at significant purchases like real estate or machinery; Microloans for smaller needs and startups; and SBA disaster loans, designed to help businesses recover from declared disasters. Each type targets different aspects of business financing, providing a range of options to support small businesses in their growth and recovery efforts.

%20cmprssd.jpg)